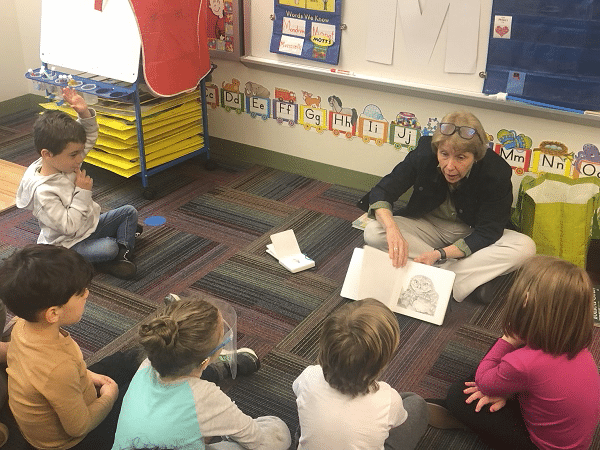

Support Early Intervention with PA Tax Credits

Educational Improvement Tax Credit Program (EITC)

Convert your tax dollars into a donation to SAILL Preschool

Any PA business or individual subject to state taxes may be eligible.

Contact Deneen Underwood with any questions.

412-924-1012 x108

Apply for a tax credit

with a two-year commitment

100% on the first $10,000 and

90% of your remaining donation.

C-corporations, S-corporations, partnerships, LLC's, most pass-through companies and qualified Subchapter S Trusts are eligible.

Consult your tax professional for specific tax advice or to confirm eligibility.

Facilitating the Process

BLOCS assists businesses and qualified individuals with the EITC application process and facilitates participating by providing guidance including timelines, documentation, and compliance.

Contact Stephanie via email or telephone for assistance with your application.