Give the Gift of Speech through PA EITC Program

Educational Improvement Tax Credit Program (EITC)

Convert your tax dollars into a donation to SAILL Preschool

Any PA business or individual subject to state taxes may be eligible.

Contact Deneen Underwood with any questions.

412-924-1012 x108

Apply for a tax credit

with a two-year commitment

100% on the first $10,000 and

90% of your remaining donation.

C-corporations, S-corporations, partnerships, LLC's, most pass-through companies and qualified Subchapter S Trusts are eligible.

Consult your tax professional for specific tax advice or to confirm eligibility.

Why Partner with SAILL Preschool for Your EITC Contributions?

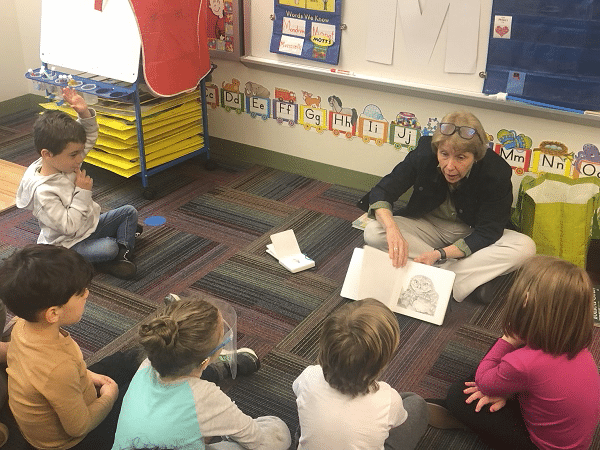

SAILL Preschool is committed to ensuring that every child, regardless of background or ability, has the tools to communicate effectively. Voluminous research supports an immersive approach to speech therapy. Absent of this, these children are under-prepared to enter kindergarten.

Who We Serve

- Children with severe speech and language delays regardless of hearing ability.

- Children needing intensive speech, language, and literacy-focused curriculum.

- Children diagnosed with Childhood Apraxia of Speech.

- Children learning English as a second language.

Long-Term Impact of EITC Support

- Children from diverse financial backgrounds can access specialized services.

- More children gain the skills to succeed in mainstream classrooms.

- A stronger, more inclusive future for children with communication challenges.

Transformative Early Intervention

When children are not able to speak for themselves in kindergarten, learning success is compromised.

Our program is more than preschool, it's a launchpad for lifelong communication skills.

- Intensive, language-rich, full-day preschool program.

- Speech and listening skills to enter mainstream kindergarten with confidence.

- Building communication skills for lifelong success.

- Parents and caregivers are actively involved through resources, training, and ongoing support.

Expert Staff and Innovative Tools

We combine expertise, technology, and personal attention.

- Highly trained teachers and speech-language pathologists.

- Small class sizes for individualized instruction.

- Latest technology and cutting-edge learning tools to enhance development.

Facilitating the Process

BLOCS assists businesses and qualified individuals with the EITC application process and facilitates participating by providing guidance including timelines, documentation, and compliance.

Contact Stephanie via email or telephone for assistance with your application.

EITC Program - Frequently Asked Questions

What is the Pennsylvania EITC Program? The Pennsylvania Educational Improvement Tax Credit (EITC) program allows Pennsylvania businesses and eligible individuals to redirect their state tax dollars to approved educational programs. By donating through EITC, you can directly support SAILL Preschool's specialized early intervention instead of sending those funds to the general tax pool.

How do EITC donations help SAILL Preschool? EITC contributions provide critical funding for our full-day, language-rich preschool program. Your support helps children with severe speech and language delays including those with Childhood Apraxia of Speech, children learning English as a second language, regardless of hearing ability gain the skills they need to enter mainstream kindergarten and achieve lifelong success.

Who can participate in EITC contributions? Businesses (corporations, partnerships, LLCs) and eligible individuals in Pennsylvania who pay specific state business taxes can apply for the EITC program through the PA Department of Community and Economic Development (DCED).

How does PA BLOCS simplify the EITC donation process? We partner with PA BLOCS to make the process simple and stress-free. PA BLOCS manages all paperwork, confirms eligibility, creates Special Purpose Entities for individuals, and tracks contributions so your EITC donation is handled efficiently, saving you time while ensuring your donation makes the maximum impact for children at SAILL Preschool.

Are EITC contributions tax-deductible? Yes. You will receive a Pennsylvania state tax credit for your EITC contribution, and it may also qualify as a charitable deduction on your federal taxes. This is one of the most tax-efficient ways to invest in a child's future.

How do I donate through EITC to benefit SAILL Preschool? Once approved for the EITC program through DCED, designate your contribution to SAILL Preschool. Our team and PA BLOCS will ensure your donation is processed correctly and directly supports specialized teaching, advanced technology, and inclusive early education.

What are the deadlines? Returning donors and two-year commitments begin May 15 and new applications on July 1.